New Ideas For Selecting A Trade RSI Divergence

Wiki Article

Trade RSI Divergence Using Cleo.Finance!

Divergence refers to the direction of an indicator and the value of an asset change in opposite directions. The ability to identify divergence between price and momentum indicators, such as the RSI and MACD is a valuable instrument to detect possible changes in the direction of an asset's price and is a key element of numerous trading strategies. We are thrilled to reveal that you are now able to use divergence to create closing and open conditions for your trading strategies using cleo.finance! View the most popular forex backtesting software free for website advice including trading with divergence, crypto trading, crypto trading, backtesting, stop loss, cryptocurrency trading bot, automated trading software, divergence trading, best trading platform, best forex trading platform and more.

There Are Four Major Kinds Of Divergences.

Bullish Divergence

Price has lower lows and technical indicators show higher lows. This is a sign of the decline in momentum in the downtrend. A reversal towards the upside can be expected.

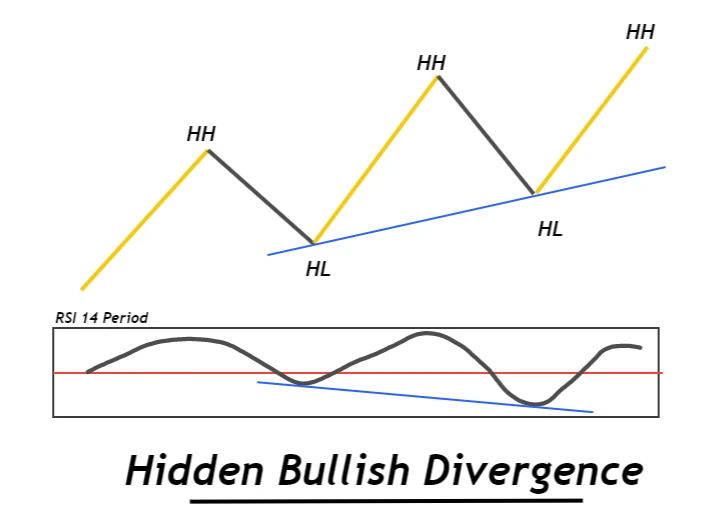

Hidden Bullish Divergence

The oscillator has lower lows, but the price is able to make higher lows. Hidden bullish divergence is an indication that the uptrend continues. This can be seen in the midst of a price throwback , or Retracement.

Hidden Bullish Divergence Explanation

Quick Notes: The price moves up when there are troughs that occur in an upward trend drawback.

Bearish Divergence

When price is creating higher highs and the indicators that show lower highs, this suggests that the price is creating more highs. This indicates that the momentum to the upside has slowed, and it is anticipated to shift towards the negative.

Bearish Divergence Explanation

Quick Notes: if you are watching the peaks in an uptrend, the indicator moves down first

Hidden Bearish Divergence

The oscillator shows higher levels than the price, but the price is making lower highs. A hidden bearish divergence suggests that the downtrend will continue. It is usually located at the tail end an upward price pullback (retracement upwards).

Hidden Bearish Divergence Explanation

Quick Notes

Regular divergences provide a reversal signal

A trend reversal can be indicated by frequent divergences. These signals are a sign that the trend is strong, but its momentum has dropped. This could be a sign of the possibility of changes in direction. These can be effective triggers for entry. See the top best forex trading platform for more info including crypto trading backtesting, software for automated trading, RSI divergence, backtesting trading strategies, forex backtesting software, divergence trading forex, automated trading platform, RSI divergence, crypto trading bot, best trading platform and more.

Hidden Divergences Signal Trend Continuation

On the other hand hidden divergences are continuation signals which typically occur within the middle of the course of a trend. They can signal that the current trend may peRSIst after an upward pullback. Traders use hidden divergences to join in with the current trend after a pullback.

Validity Of The Divergence

Divergence can be used in conjunction with a momentum indicator like RSI or the Awesome oscillator. These indicators only focus on the present momentum so trying to find a divergence more than 100 candles back isn't possible. However changing the period of the indicator affects the look-back range of an actual divergence. Be cautious when deciding the legitimacy of the divergence. Divergences may not be valid.

Available Divergences in cleo.finance:

Bullish Divergence

Bearish Divergence

Hidden Bullish Divergence:- See the top backtesting tool for more tips including trading platform cryptocurrency, best forex trading platform, backtesting platform, automated trading software, RSI divergence, automated crypto trading, forex backtesting software, forex backtesting software free, backtester, cryptocurrency trading botand you can compare those divergences between two points:

Price With An Oscillator Indicator

A combination of an oscillator indicator with another indicator. price of any asset in conjunction with another asset.

An overview of how to utilize divergences in the cleo.finance builder

Hidden Bullish Divergence cleo.finance - Open conditions for building

Customizable Parameters

Four parameters are able to be edited for all divergences , so traders can modify their strategies to diverge.

Lookback Range (Period)

This parameter determines how far back the strategy must seek out divergence. The default value of 60 is indicated that the strategy is to look for divergence in the past 60 bars.

Min. Distance Between Peaks/Troughs (Pivot Lookback Left)

This parameter will tell you how many candles must be lit on both sides of the pivot point in order to verify that it is located.

Confirmation bars (Pivot Lookback Right)

This parameter specifies how many bars along the right are needed to confirm that the pivot point is found. Have a look at the most popular online trading platform for blog examples including trading platforms, best trading platform, backtesting, forex trading, position sizing calculator, forex backtesting software, backtesting tool, backtesting platform, forex tester, backtesting strategies and more.

Timeframe

This section lets you determine the period of time during which the divergence should take place. This timeframe can be different from the execution timeframe of the strategy.Customizable parameter settings of divergences on cleo.finance

The parameters for the Divergences parameter for cleo.finance

The peak and the trough are determined by the pivot point settings. The default settings for a bullish diveRSIfication should be kept.

Lookback Range (bars: 60)

Min. Distance between troughs, (left) = 1

Confirmation bars Right = 3

This means that both the valleys of the divergence must be within the next five bars (lower then 1 bar to either side or 3 bars to one side). This should be the case for both troughs which can be found within the last 60 candles (lookback period). The nearest pivot point will be able to confirm the divergence three bars later.

Available Divergencies In Cleo.Finance

These oscillators are commonly employed together with RSI Divergence and MACD Divergence. Any other oscillator could be tested and live tradeable with the trading automation platform cleo.finance. See the best forex backtesting software for blog examples including automated cryptocurrency trading, crypto backtesting, software for automated trading, forex trading, backtesting, backtesting trading strategies, forex backtest software, automated trading bot, backtesting tool, automated trading and more.

In Summary

Divergences are an essential instrument for traders to add to their arsenal, but they must be utilized with care and in a strategic way. This can help traders make more informed trading decisions through the use of divergences. The best approach to divergences is an organized and strategic approach. They can be used in conjunction with other kinds of fundamental or technical analysis like Support and Resistance lines. Fib retracements and Smart Money Concepts will increase your conviction that the divergence is real. Learn more about our Risk Management guides on position size and stop loss position. You can begin designing your ideal trading strategies for divergence right now with more than 55 indicators for technical analysis such as price action, price, and candlesticks data points! The cleo.finance site is continually evolving. Send us a request if you need an indicator or data point.